Let’s be more practical today and learn some advanced accounting techniques.

After summaries of standards related to consolidation and group accounts, I’d like to show you how to prepare consolidated financial statements step by step.

I’ll do it on a case study, with explaining what I do and why. If you don’t like reading, you can skip to the end of this article and watch my video.

If you’d like to revise a theory first, then please read my summary of IFRS 3 Business Combinations and IFRS 10 Consolidated Financial Statements, both of them contain video in the end.

Here’s the question:

Mommy Corp has owned 80% shares of Baby Ltd since Baby’s incorporation.

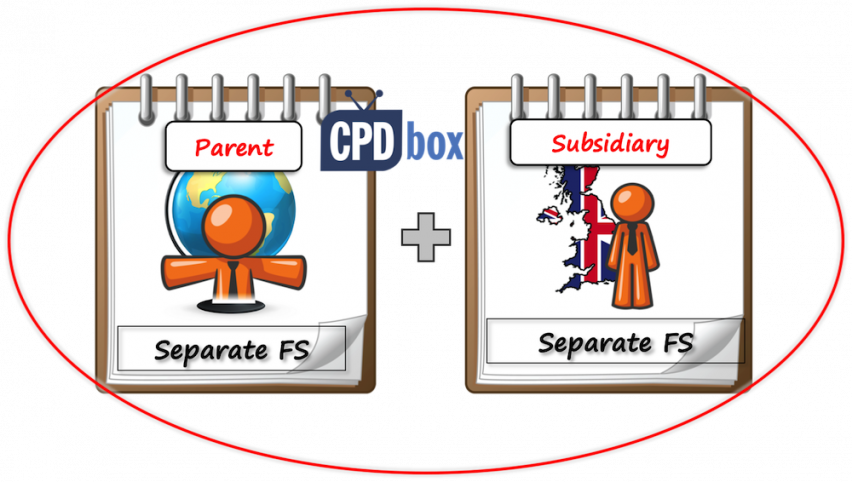

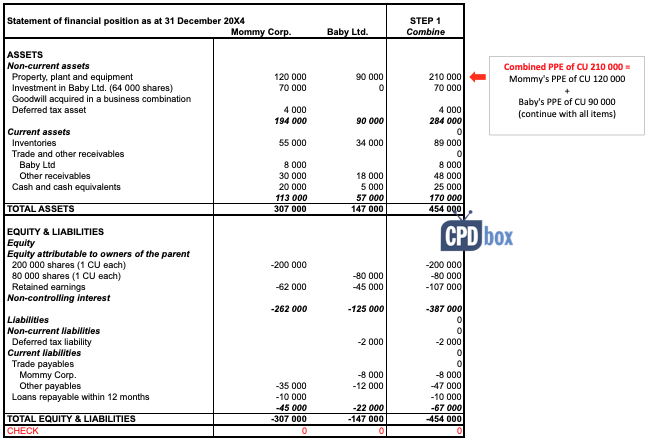

Below there are statements of financial positions of both Mommy and Baby at 31 December 20X4.

Prepare consolidated statement of financial position of Mommy Group as at 31 December 20X4. Measure NCI at its proportionate share of Baby’s net assets.

Please note here that in the above statements of financial position, all assets are with “+” and all liabilities are with “-“. I use it this way because for me it’s easier to verify and identify mistakes, but it’s up to you.

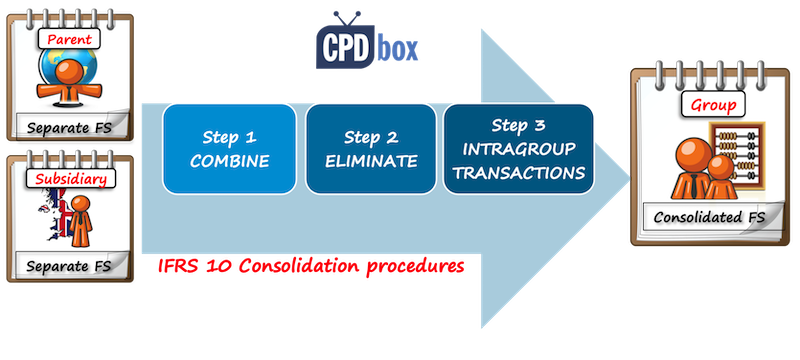

I have described the consolidation procedures and their 3-step process in my previous article with the summary of IFRS 10 Consolidated financial statements, but let me repeat it here and follow these steps:

After you make sure that all subsidiary’s assets and liabilities are stated at fair values and all the other conditions are met, you can combine, or add up like items.

It’s very easy when a parent (Mommy) and a subsidiary (Baby) use the same format of the statement of financial position – you just add Mommy’s PPE and Baby’s PPE, Mommy’s cash and Baby’s cash balance, etc.

Special For You! Have you already checked out the IFRS Kit ? It’s a full IFRS learning package with more than 40 hours of private video tutorials, more than 140 IFRS case studies solved in Excel, more than 180 pages of handouts and many bonuses included. If you take action today and subscribe to the IFRS Kit, you’ll get it at discount! Click here to check it out!

In reality, companies use their own format for presenting their financial position and therefore it can be difficult to combine. That’s exactly WHY so many groups use their “consolidation packages” and subsidiaries’ accountants must fill them up along with preparing own financial statements.

Therefore, when a group controller calls you every five minutes to remind you the consolidation package, you’ll know why!

In our case study, combined numbers looks as follows:

Of course, there are some strange and redundant numbers, for example both Mommy’s and Baby’s share capital, but we haven’t finished yet!

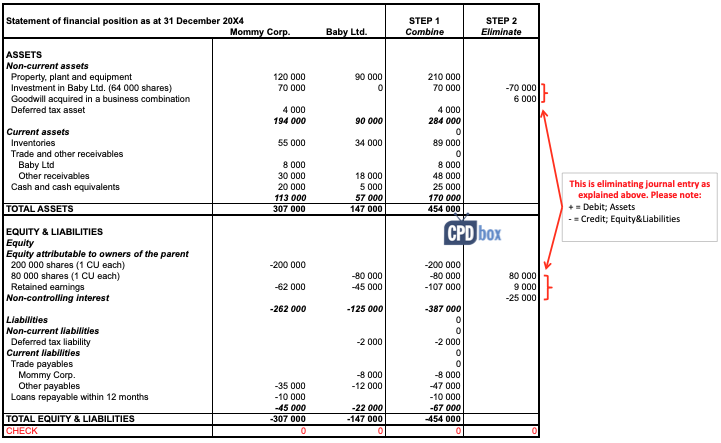

After combining like items, we need to offset (eliminate):

and of course, recognize any non-controlling interest and goodwill.

So let’s proceed. The first two items are easy – just remove Mommy’s investment into Baby (CU – 70 000), and remove Baby’s share capital in full (CU + 80 000).

As there is some non-controlling interest of 20% (please see below), you need to remove its share in Baby’s post-acquisition retained earnings of CU 9 000 (20%*CU 45 000).

Wait a second – how do we know that all Baby’s reserves (retained earnings) of CU 45 000 are post-acquisition?

Well, the question says that Mommy has owned Baby’s shares since its incorporation, therefore full Baby’s retained earnings are post-acquisition.

Be careful here, because you absolutely need to differentiate pre-acquisition retained earnings from post-acquisition retained earnings, but here, we’re not going to complicate the things.

Then we need to recognize any non-controlling interest and goodwill.

Mommy has owned 80% of Baby’s share and therefore, non-controlling interest owns remaining 20% of Baby’s net assets.

The question asks to measure non-controlling interest at proportionate share on Baby’s net assets, so here’s how it looks like at the end of the reporting period:

Baby’s net assets are CU 125 000 as at 31 December 20X4, including Baby’s share capital of CU 80 000 and Baby’s post-acquisition reserves of CU 45 000.

Non-controlling interest at 31 December 20X4 is 20% of Baby’s net assets of CU 125 000, which is CU 25 000. Recognize it with minus, as we are crediting equity with non-controlling interest.

There might be some goodwill arisen on initial recognition. If you’d like to learn more about goodwill, please refer to the article about IFRS 3 Business Combinations.

Let’s calculate it. Please don’t forget that we calculate goodwill based on numbers on acquisition, not on 31 December 20X4.

The goodwill is calculated as:

Goodwill acquired in a business combination comes to CU 6 000 (70 000 + 16 000 – 80 000).

The elimination entry looks as follows (sign “+” indicates a debit entry; sign “-“ indicates a credit entry):

| Description | Amount | Debit | Credit |

| Remove Mommy’s investment in Baby | -70 000 | FP – Investment in Baby | |

| Remove Baby’s share capital in full | +80 000 | FP – Baby’s share capital | |

| Remove 20% (NCI) of Baby’s post-acquisition retained earnings | +9 000 | FP – Retained earnings | |

| Recognize non-controlling interest on 31 December 20X4 | -25 000 | FP – Non-controlling interest | |

| Recognize goodwill acquired in a business combination | +6 000 | FP – Intangible assets (goodwill) | |

| Check | 0 |

I have transferred this journal entry into our consolidation worksheet and it looks as follows:

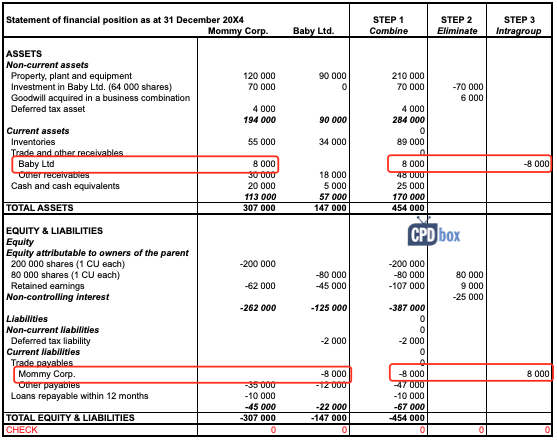

Parents and subsidiaries trade with each other very often.

However, when you look at both parent and subsidiary as at 1 company, which is the purpose of consolidation, then you find out that there’s no transaction at all.

In other words, group has not performed any transaction from the view of some external user.

Therefore you need to eliminate all transactions happening within the group, between a parent and its subsidiaries.

Looking to above individual statements of financial position of Mommy and Baby you see that Mommy has a receivable to Baby of CU 8 000 and Baby has a payable to Mommy of CU 8 000. Perhaps these 2 items relate to the same transaction between them and we need to eliminate them, by debiting payables and crediting receivables:

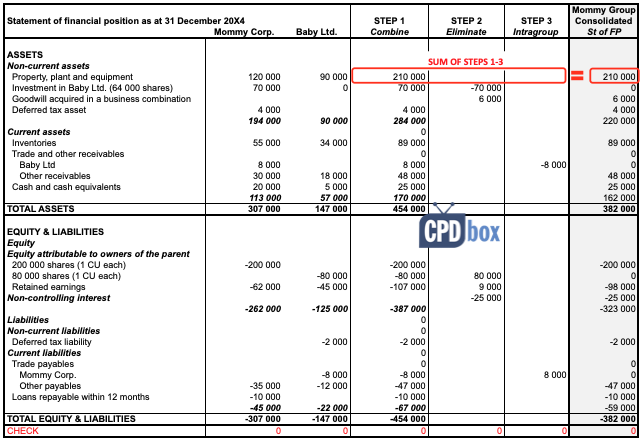

After we have completed all steps or consolidation procedures, we can add up all the combined numbers with our adjustments and thus we arrive at consolidated statement of financial position.

You can revise all the steps and formulas in Excel file that you can download at the end of this article.

Here’s how it looks like:

Please note the following facts:

I know that many of you prepare for your exams and this is NOT the way how you learned consolidation during exam preparation courses.

OK, I understand.

I prefer this way of making consolidation by far, because here, you go systematically, step by step. You can deal with each adjustment in a separate column and as a result, your numbers will always balance. You will never forget anything.

The “exam-style” of making consolidated financial statements is good and easy when there are just a few issues or complications.

Special For You! Have you already checked out the IFRS Kit ? It’s a full IFRS learning package with more than 40 hours of private video tutorials, more than 140 IFRS case studies solved in Excel, more than 180 pages of handouts and many bonuses included. If you take action today and subscribe to the IFRS Kit, you’ll get it at discount! Click here to check it out!

But when you need to deal with more complex situations, then you can forget or omit the things very easily. Trust me, I did it too.

However, to make you happy, you can find the same case study solved “by the exam-style” in the attached excel file that you can download in the end of this article.

But in most cases, there is lots of issues or circumstances that you need to take into account and exactly their significance and amount makes it all difficult.

What issues? For example:

I can go on and on, but I don’t want to discourage you. However, if you need to know more about all these issues, I have covered them fully in my premium learning package the IFRS Kit, so please check out if interested.

Please watch the video here:

Further reading: Here’s the example of consolidation where a subsidiary has different functional currency than its parent. You’ll learn how to translate the subsidiary’s financial statements.

If you like this example and explanations, please help me spread a word about it and share it with your friends. Thank you! 1518169940415 -->

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

42 / 190Hi Silvia,

maybe not the right platform for the question, but I’m wondering when a parent in the acquisition of a subsidiary takes over a subsidiary’s liabilities to a third party, how is that accounted for in the subsidiary’s separate financial statement ( the parent’s acquisition cost includes the repayment of the subsidiary’s liabilities to third parties)

Hi Anna, that depends on the contract between the subsidiary and the new parent, if there is any. If not, the subsidiary is still liable to the third party and cannot derecognize the liability.

Thanks for your reply!

According to the contract, the mother pays the daughter’s liability as the purchase price of the daughter, as a result, in the the daughter company accounts payable is debited, the debit is questionable to me.

OK, so I would say the Debit is the liability, and credit would be some capital contribution from the new parent in equity, because 1. subsidiary is no longer liable to pay, so you need to derecognize that liability to the third party; 2. contributions from owners are treated separately from other income/inflow items.

Hi Silvia,

Thanks for the article, I’ve a question here and appreciate if you could advise. If my subsi’s investor paid at premium and as holding i pay at par value , i have recorded a share premium in my subsi account. Upon consolidation, do I need to eliminate the share premium and recognise negative goodwill or can i present the share premium number as it is in consolidated balance sheet? thanks!

Hi E,

upon consolidation, you should treat share premium of a subsidiary the same way as you treat its share capital – that is, eliminate and include in the goodwill calculation. S.

Hi Silvia, thanks for your reply! In my case the holding is pay at par value and investor pay at premium. Does this consider a bargain purchase and negative goodwill should be calculated upon consolidation? Thanks!

I can’t say without seeing the net assets of that investment.Hi Silvia, thanks for the insightful article. I have question on how to attribute post-acquisition profit to NCI where a shareholders’ agreement exists that modifies the profit entitlement of the subsidiary’s shareholders. Lets consider an example of a 60% owned subsidiary and the agreement between its shareholders’ provides the following: 1. The 40% share capital to be contributed by the other shareholders (hereafter referred to as “NCI”) shall be paid up by the parent company (who is the 60% shareholder) in form of advancement to NCI. 2. The advancement shall be repaid to the holding company by way of setting off against future dividend to be distributed to NCI. In the absence of the above factors, the consolidated income statements of the parent company should report the profit attributable to the parent company and NCI based on their respective ownership interest. This would result in attributing CU 40 to NCI if the current year profit of the subsidiary is CU 100. However, having the additional factors in mind, if the advancement owed by NCI is CU 40, and should there be any dividend distribution in the future, NCI will never get paid for the CU40 profit attributed to them because the payment will instead be diverted to the holding company to settle the advancement they owe. In that sense, should the CU 40 profit be attributed to NCI at the first place?

Daniel Salas January 30, 2024 at 1:33 pmHi Silvia When we need to adjust the Subsidiary net assets to fair value – do we do revaluation entries in the consolidate statements ? For example, if we need to recognise client lists or provisions that wouldn’t be in the individual statements – do we debit assets client lists and credit p&l Or debit PPE – credit revaluation reserve ? What about the provisions for probable liabilities ?

Hi Daniel, you do all adjustments when consolidating, but in the separate statements. If you are subscribed to our courses, there’s a full solved example about it.

How to account for the pre – acquisition deficit in an asset acquisition? In a business combination, this would be accounted when calculating goodwill.

What is the difference between GAAP and IFRS when considering consolidation to GAAP financials in the US.

Basically they are completely different sets of accounting and reporting rules. Please see more here.

Hi Silvia If I have company A which has associate B and B has subsidairy C 100%

Now Company A wants to acquire full C

What the impact in books of Company A and Company B

I just wanted to thank you for this amazing, wonderful and extraordinary work you do for us students. You really make IFRS more digest. you are a STAR!

Srikrishnan August 15, 2022 at 3:35 amThanks Silvia. Helpful.

Few requests, pl..

1)Step 2: Eliminate – removing Baby’s share capital in full ,ie.CU 80 000. Could we remove only 64000, ie. the parent’s portion of Baby’s equity instead?

2)Removal of 20% NCI of Baby’s post-acquisition retained earnings: Why is this required, pl.?

Hi Selva- What is the possible case, that a dividends from subsidiaries are shown on the consolidated statement of cash flow only ?!

Hi Silvia, I have a question on consolidation and I hope that you can share your opinion on this problem.

The background of the case was as follows: Company A asked its directors to set up a company (Company B) in Country X in the 1980s. The shares in Company B are registered under the individual directors name. Company B operates independently from Company A and there was no information whether Company A has control over Company B. In 2020, the new management of Company A sued the former directors and claimed that the shares held by them in Company B are in trust for Company A. In 2021, Company A won the suit and the Court passed a judgment saying that Company A is the rightful owner of the shares in Company B. The Court also ordered the former directors to pay Company A legal costs and all the dividends (plus interest) they received from Company B in those years. In 2022, the shares in Company B are successfully transferred to Company A and Company B become a wholly owned subsidiary of Company A. My questions are: (a) Is this a prior year adjustment? Can Company A recognise Company B as subsidiary in 2022 on the basis that Company A does not have control over B until the shares have been transferred? (b) If Company A recognised Company B as subsidiary in 2022, what is the “cost of investments” amount to be recorded in A books? Is it legal fees incurred by Company A or the share capital of Company B? (c) How does Company A record the compensation received (past dividends, interest and legal costs) from the former directors? (d) How does the above transactions recorded in the Group level? Thank you for your help.

Kelvin

Thank you Silvia for your illustration ,

If you don’t mind I have two questions regarding the consolidation, the first one why we eliminate the retained earnings that exits at the acquisition date (or before the acquisition date) ? is it like the amount that it’s hidden for the future that the investor will take it from the investee ? the second question when we eliminate intragroup transactions regarding purchasing of PPE or Inventory : if the sale is made from the parent to its subsidiary why we do not reduce the subsidiary share for unrealized profit since the subsidiary will take part of the net Assets (equity) that are attributable to (non-controlling interest)? in other words if the net assets affected for the group the net assets for the non-controlling interest will be affected also.

Thank you in advance.

Regards,

Mohammad Obeid

1. Because they enter in the goodwill calculation and do not belong to the group as they were achieved prior acquisition date.

2. Because the parent made unrealized profit, not the subsidiary, in your outlined transaction.

Mohammed, I strongly recommend you to look inside the IFRS Kit, because these questions are all solved there.

Thank you for your response and advice,

In reference to answer No. 2 , in your videos when the Subsidiary made sale to its parent you allocate the amount of unrealized profit also to Controlling interest(parent share in Retained Earnings , 80% of the total amount) although the amount of unrealized profit should reflect the non-controlling interest.

Thanks in advance.